In the fast-paced world of investments, where risks and rewards dance on the edge of a razor-thin line, one strategy stands out as a beacon of potential profit: Call Option trading. Imagine a thrilling financial realm where strategic decisions can lead to lucrative gains or heart-pounding losses at the blink of an eye. It’s here that investors delve into the intricacies of the stock market, employing tactics that require not only knowledge but also a keen sense of timing and intuition. As we unravel the layers of this captivating art, you will be guided through the labyrinth of Call Option trading, where every move holds the promise of unlocking untapped profit potential. This blog post is your key to understanding the dynamics of this investment strategy, where the power to harness market fluctuations lies in your hands. Join us on this enlightening journey as we demystify the complexities of Call Option trading, offering you insights that could pave the way to financial success in the ever-evolving landscape of the stock market.

The Fundamentals of Call Options

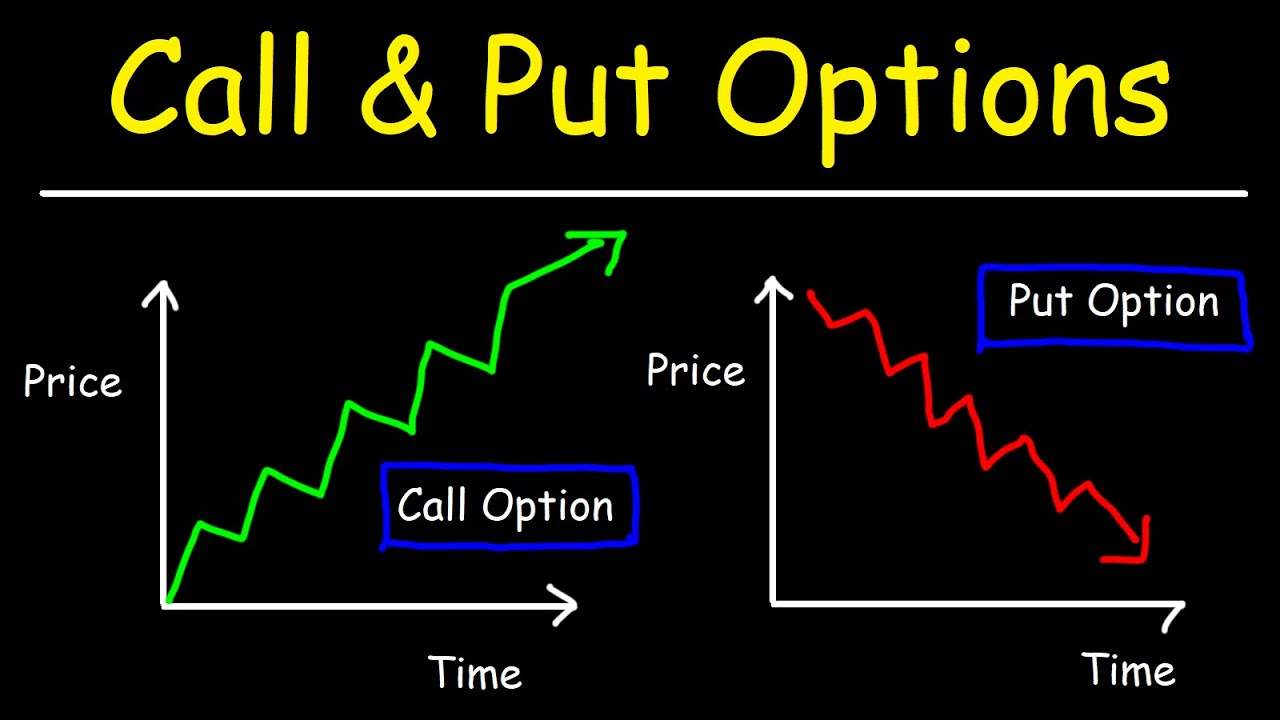

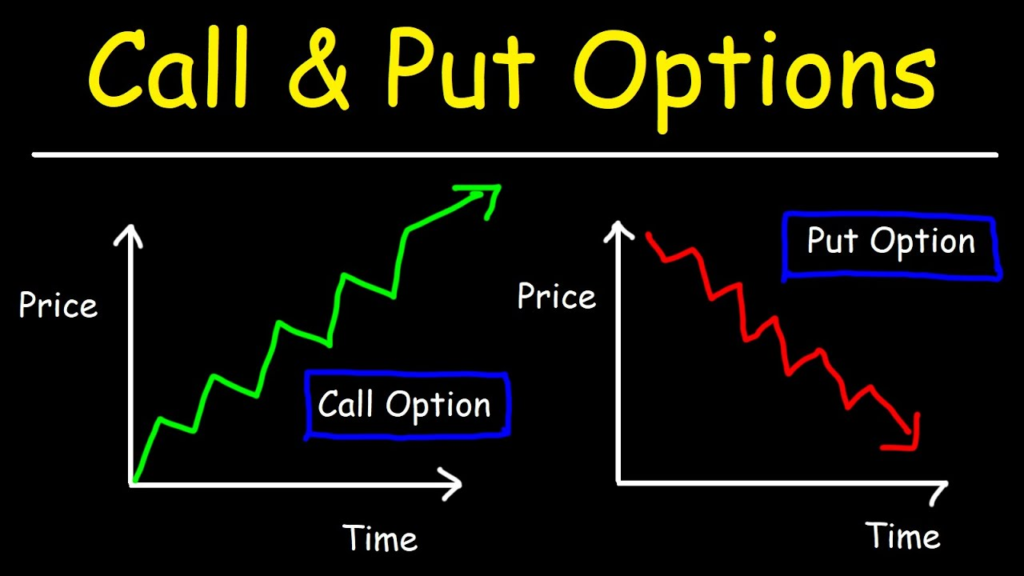

When delving into the fundamentals of call options, it’s essential to understand their role in Call Option trading. These financial instruments provide the right, but not the obligation, to buy an underlying asset at a specified price within a set timeframe. Traders use call options to speculate on rising asset prices, aiming to capitalize on profit potential. By mastering the art of call option trading, investors can leverage market movements to enhance their investment strategies and optimize returns in the dynamic world of finance.

Understanding Call Option Contracts

Call option contracts give traders the right to buy an underlying asset at a predetermined price before a specified date, allowing investors to benefit from price increases without owning the asset. In call option trading, traders pay a premium for this right, which offers leverage and profit potential. Understanding call option contracts is crucial for traders looking to maximize their investment opportunities.

The art of call option trading lies in analyzing market trends, assessing risks, and timing purchases effectively. By mastering these skills, traders can unlock profit potential and capitalize on market fluctuations. With proper research and strategy, call option trading can be a lucrative investment tool for traders seeking to diversify their portfolios and enhance their financial returns.

Factors Influencing Call Option Prices

Factors influencing call option prices are crucial in the world of call option trading. Understanding these factors can help traders make informed decisions and unlock profit potential. The art of call option trading lies in grasping how various elements impact option prices.

Market conditions, time to expiration, underlying asset price, interest rates, and volatility all play significant roles in determining call option prices. Traders keen on mastering call option trading must analyze these factors meticulously. By having a deep understanding of what influences call option prices, investors can strategically navigate the market and maximize their profit margins. Expanding knowledge on these factors is essential for anyone looking to excel in the world of call option trading.

Strategies for Call Option Trading Success

When diving into the world of call option trading, it’s crucial to have well-thought-out strategies in place for success. Understanding the market dynamics and staying updated with the latest trends are key elements to master the art of call option trading. By analyzing risk-reward ratios and implementing effective stop-loss mechanisms, traders can maximize their profit potential in this volatile market.

Moreover, conducting thorough research on underlying assets and staying disciplined in executing trades can significantly enhance one’s trading success. By utilizing technical analysis tools and keeping emotions in check, traders can make informed decisions that lead to profitable outcomes. Remember, patience and continuous learning are essential traits for traders looking to excel in the realm of call option trading.

Risks Associated with Call Option Trading

When engaging in **Call Option trading**, it’s crucial to understand the risks involved. Market volatility can lead to unexpected price fluctuations, impacting the value of your options. Moreover, time decay is a significant risk factor as options lose value as the expiration date approaches.

Another risk to consider is the possibility of losing the entire investment if the market doesn’t move in the anticipated direction. It’s essential for traders to set stop-loss orders to manage potential losses effectively. Additionally, being aware of implied volatility changes is key as it can significantly impact option prices. By staying informed and implementing risk management strategies, traders can navigate the risks associated with **Call Option trading** more effectively.

Leveraging Market Trends in Call Option Trading

Leveraging market trends is crucial in call option trading, where understanding the ebb and flow of the market can lead to substantial gains. By closely monitoring market trends, traders engaging in call option trading can capitalize on upward price movements of underlying assets. This strategy allows investors to benefit from the potential profits without owning the asset itself, making call options an attractive investment tool.

Successful call option trading requires a deep understanding of market dynamics and the ability to predict future price movements. By staying informed about market trends and analyzing relevant data, traders can make informed decisions to maximize their profit potential. Implementing sound strategies based on market trends is key to navigating the complexities of call option trading effectively.

Unleashing Profit Potential: Real-life Call Option Trading Examples

Exploring real-life call option trading examples can provide valuable insights into unlocking profit potential in the financial markets. By understanding the art of call option trading, investors can leverage market fluctuations to their advantage. Through strategic analysis and timely execution, call option traders can capitalize on upward price movements and maximize returns.

In the world of call option trading, knowledge is power. By studying diverse call option trading examples, traders can enhance their decision-making process and cultivate a deeper understanding of market dynamics. From risk management to profit optimization, mastering the nuances of call option trading is essential for those aiming to thrive in the ever-evolving landscape of financial markets.

Call Option Trading Tips for Beginners

When it comes to **Call Option trading**, beginners should consider a few key tips to maximize their potential profits. Firstly, understanding the basics of call options is crucial. A call option gives the buyer the right, but not the obligation, to buy a stock at a specified price within a certain timeframe. This financial tool can be a powerful asset if utilized correctly.

Secondly, beginners should focus on researching and analyzing the underlying asset before making any **Call Option trading** decisions. Conducting thorough market research and staying updated on financial news can help in making informed choices. By following these essential tips, beginners can navigate the world of **Call Option trading** more confidently and increase their chances of success in the financial markets.

Embracing the Future: Advanced Call Option Trading Techniques

Delve into the exciting realm of call option trading to unlock new profit potential. By embracing advanced techniques, you can navigate the complexities of the market with confidence. Stay ahead of the curve by mastering strategies that maximize gains while minimizing risks in call option trading.

Understanding the nuances of call option trading is essential for success in the financial markets. Explore innovative approaches that can help you make informed decisions and optimize your investment portfolio. Embrace the future of trading by incorporating advanced techniques that leverage the power of call options to enhance your financial goals.

Conclusion: Mastering the Art of Call Option Trading

Mastering the art of call option trading requires a deep understanding of how this financial instrument works. Call option trading is a strategy that allows investors to benefit from the price movements of an underlying asset without owning it. By purchasing a call option, traders have the right, but not the obligation, to buy the underlying asset at a predetermined price within a specific timeframe.

To excel in call option trading, one must grasp key concepts such as strike price, expiration date, and premium. Additionally, mastering technical analysis and market trends can significantly enhance trading success. By implementing proper risk management strategies and staying informed about economic indicators, traders can unlock the profit potential of call option trading and capitalize on market opportunities effectively.