In the intricate world of finance, where every decision made can have a ripple effect on one’s financial success, mastering the art of strike price trading emerges as a beacon of hope for those navigating the tumultuous waters of investments. Imagine a scenario where every move you make in the stock market is calculated, strategic, and poised to yield maximum returns. This blog post aims to delve deep into the realm of strike price trading, unraveling its complexities, and providing you with a comprehensive guide to unlocking the doors to financial prosperity. As you embark on this enlightening journey, you will discover the significance of strike price trading in reshaping your investment strategies. From understanding the fundamentals to implementing advanced tactics, this guide is your passport to harnessing the power of strike price trading for optimal financial gains. By the end of this post, you will not only have a newfound appreciation for the nuances of this trading technique but also be equipped with the knowledge and confidence to make informed decisions that could potentially pave the way to your financial triumph. So, fasten your seatbelts, dear readers, as we embark on a riveting exploration of strike price trading – where calculated risks meet lucrative rewards.

Understanding Strike Price Trading Fundamentals

When delving into **strike price trading**, it’s essential to grasp the fundamental concepts to navigate the financial markets successfully. Understanding the role of strike prices is crucial in options trading, as they determine the price at which an option can be exercised. Traders use strike prices to make informed decisions based on market predictions and risk tolerance levels.

**Strike price trading** fundamentals involve evaluating various factors such as market trends, volatility, and expiration dates to make strategic investment choices. By mastering the art of selecting optimal strike prices, traders can enhance their profitability and minimize potential risks in the dynamic world of financial trading. This comprehensive guide provides invaluable insights into leveraging strike prices effectively to achieve your financial goals.

Importance of Strike Price Selection

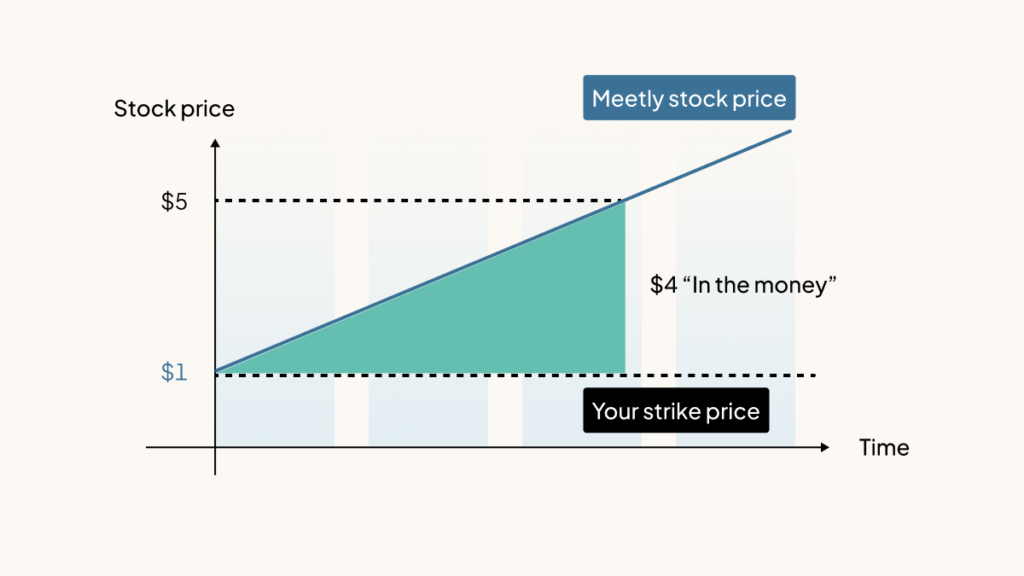

When it comes to **strike price selection** in trading, understanding its importance is crucial for success. The **strike price** is the predetermined price at which an option can be bought or sold. Choosing the right strike price is a strategic decision that can significantly impact your trading outcomes.

**Mastering strike price trading** involves analyzing market conditions, assessing risk tolerance, and setting clear financial goals. By selecting an appropriate strike price, traders can optimize their profit potential while minimizing risks. Whether trading call or put options, the **strike price** plays a key role in determining profitability. Make informed decisions based on market research and technical analysis to enhance your chances of financial success in the dynamic world of options trading.

Types of Option Contracts in Strike Price Trading

In strike price trading, various option contracts play a crucial role in determining investment outcomes. Understanding the types of option contracts based on the strike price can significantly impact your financial success. Call options give the holder the right to buy an asset at a specified strike price, while put options allow selling at the strike price. These contracts provide flexibility and strategic opportunities in strike price trading.

Furthermore, in strike price trading, investors can choose between in-the-money, at-the-money, and out-of-the-money options based on the relationship between the strike price and the current market price. Each type offers different risk-reward profiles and can be utilized depending on market conditions and investment objectives. Mastering the nuances of these option contracts is essential for maximizing returns and managing risks effectively in strike price trading.

Strategies for Successful Strike Price Trading

When delving into the realm of strike price trading, it’s vital to have solid strategies in place to maximize your success. One key approach is to conduct thorough research and analysis before setting your strike price. By understanding market trends and evaluating underlying assets, you can make informed decisions that increase your chances of profitability.

Additionally, implementing risk management techniques is crucial in strike price trading. Setting stop-loss orders and diversifying your portfolio can help mitigate potential losses and safeguard your investments. By combining these strategies with a disciplined mindset and a commitment to continuous learning, you can navigate the complexities of strike price trading with confidence and set yourself up for financial growth.

Risk Management Techniques in Strike Price Trading

In the realm of strike price trading, effective risk management techniques are crucial for achieving financial success. Traders must carefully assess and analyze the risk associated with each strike price before making any decisions. By diversifying the strike prices in their portfolio, traders can mitigate potential losses and maximize profits.

Implementing stop-loss orders at strategic strike prices can help traders limit their downside risk while allowing for upside potential. Moreover, continuously monitoring market conditions and adjusting strike prices accordingly is essential for staying ahead in the fast-paced world of strike price trading. By mastering these risk management techniques, traders can navigate the complexities of strike price trading with confidence and increase their chances of financial success.

Analyzing Market Trends for Effective Strike Price Decisions

When it comes to **strike price trading**, staying on top of **market trends** is crucial for making informed decisions. By closely **analyzing market trends**, traders can effectively determine the most suitable strike prices for their options. This strategic approach enhances the chances of maximizing profits and minimizing risks in the volatile financial landscape. Successful **strike price decisions** are often a result of thorough research and a deep understanding of the current market conditions.

**Mastering strike price trading** involves not only understanding the fundamentals but also interpreting real-time data to anticipate market movements accurately. By keeping a keen eye on market trends, traders can adapt their **strike price strategies** swiftly to capitalize on emerging opportunities. In the dynamic world of finance, the ability to analyze market trends for **effective strike price decisions** can be a game-changer for achieving long-term financial success.

Leveraging Volatility to Maximize Strike Price Trading Profits

Leveraging volatility is essential in strike price trading to maximize profits. Traders can capitalize on price fluctuations by strategically selecting the right strike price based on market conditions. By understanding market volatility, traders can adjust their strike prices to optimize returns.

Mastering strike price trading requires a deep understanding of market volatility trends. By analyzing historical data and monitoring current market conditions, traders can make informed decisions on strike prices. Successful strike price trading involves adapting to changing volatility levels to enhance trading profits.

Setting Realistic Goals and Expectations in Strike Price Trading

Strike price trading, especially with options, can be exciting but also carries inherent risks. Before diving in, it’s crucial to establish realistic goals and manage your expectations to avoid disappointment and minimize potential losses. Here’s how to approach it:

- Understand Your Risk Tolerance: How much potential loss are you comfortable with? Strike price trading can be riskier than simply buying and holding an underlying asset. Be honest about your risk tolerance before selecting strike prices and position sizes.

- Start Small, Learn Consistently: If you’re new to strike price trading, begin with smaller positions and focus on understanding the mechanics and potential risks. Build knowledge and experience before scaling up your trades.

- Focus on Probability, Not Huge Windfalls: Aim for consistent, smaller gains rather than gambling on unrealistic price movements. Options trading often favors those who focus on probabilities and manage trades over time.

- Factor in Implied Volatility (IV): Options pricing is influenced by IV, which reflects market expectations of future price swings. High IV can make options more expensive, impacting potential returns.

- Don’t Expect Overnight Success: Strike price trading requires skill and patience. Focus on developing a sound strategy, understanding market dynamics, and continuously refining your approach.

Monitoring and Adjusting Strike Price Positions

Strike price trading isn’t a “set it and forget it” strategy. Proactive monitoring and adjustments are crucial for success. Here’s why and how:

- Market Changes: Underlying asset prices and volatility can change rapidly. It’s essential to monitor your positions closely and understand how these market shifts impact the potential profitability of your trades.

- Time Decay (Theta): Options lose value over time, particularly as they approach expiration. Be mindful of theta’s impact and consider adjustments if you’re holding positions for extended periods.

- Adjusting Your Approach: If market conditions change significantly or your original thesis behind a trade is no longer valid, don’t hesitate to adjust. This could involve closing the position, rolling it to a different strike price, or implementing hedging strategies.

- Position Management: Regularly evaluate the risk/reward potential of your trades. Determine if current market conditions still align with your initial expectations and adjust your positions accordingly.

Important Note: Proactive management doesn’t mean overtrading. Be strategic and methodical with your adjustments to avoid incurring unnecessary losses.

Conclusion: Embracing Financial Success Through Mastering Strike Price Trading

Strike price trading can be a powerful tool for achieving your financial goals, offering opportunities for both potential profits and enhanced portfolio management. However, success in this arena requires a combination of knowledge, discipline, and a realistic approach. By understanding the mechanics of strike prices, setting achievable expectations, and actively monitoring and managing your positions, you can increase your chances of navigating this dynamic market landscape. Remember, mastery takes time and dedication. Through continuous learning, strategic adjustments, and a focus on long-term objectives, you can unlock new possibilities and take your trading endeavors to the next level.