Are you ready to dive into the exciting world of Put Option Trading? Buckle up as we embark on a comprehensive journey that will unravel the complexities of this financial strategy, making it accessible even to beginners. Imagine having the power to potentially profit from a stock’s decline without even owning it – sounds intriguing, doesn’t it? Well, that’s the magic of put options, a versatile tool in the realm of trading that opens up a whole new realm of possibilities for savvy investors. In this guide, we will break down the intricate mechanisms of Put Option Trading, demystifying the jargon and equipping you with the knowledge and skills needed to navigate this market with confidence. Whether you’re a novice looking to dip your toes into the world of trading or a seasoned investor seeking to expand your repertoire, this blog post is your ultimate roadmap to mastering the art of put options. So, fasten your seatbelt, sharpen your analytical skills, and get ready to unlock the potential of Put Option Trading like never before.

Understanding Put Options: A Beginner’s Primer

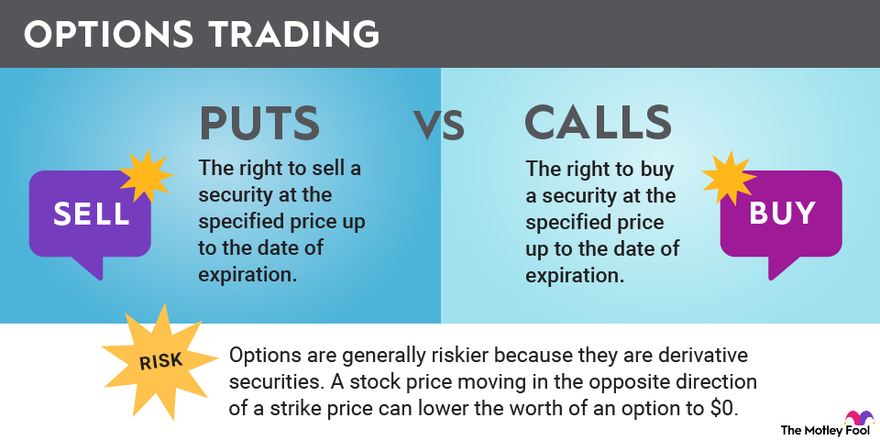

Delve into the world of put option trading as a beginner to grasp its fundamentals. Put options provide traders the right to sell an asset at a predetermined price within a specified time frame. Understanding how put options work is essential for beginners venturing into the world of trading. As a key component of options trading, mastering put options can enhance one’s overall trading strategy.

Beginners are advised to learn about the basics of put option trading, including how to profit from falling asset prices. By grasping the concept of buying put options as a way to speculate on price declines, novice traders can navigate the markets more effectively. Embracing the intricacies of put option trading equips beginners with valuable knowledge to make informed decisions when engaging in the dynamic world of trading.

Benefits of Put Option Trading in the Stock Market

Put option trading in the stock market offers several benefits for investors. One key advantage is the ability to profit from declining stock prices. By purchasing a put option, investors can secure the right to sell a stock at a predetermined price, even if its market value drops. This provides a valuable hedge against market downturns.

Another benefit of engaging in put option trading is the potential for leveraging capital. With a relatively small upfront investment, traders can control a larger position in the market. This amplifies the profit potential while limiting the risk exposure. Additionally, put options offer flexibility in trading strategies, allowing investors to capitalize on various market conditions. Overall, mastering put option trading can enhance a portfolio’s performance and provide valuable risk management tools for beginners entering the stock market.

Key Terminologies Every Put Option Trader Should Know

Understanding key terminologies is essential for mastering put option trading. One crucial term is “strike price,” which is the price at which the option holder can sell the underlying asset. Another important term is “expiration date,” indicating the date when the option contract expires and becomes invalid.

Additionally, “premium” refers to the price paid for the option contract, while “in the money” means the option has intrinsic value. Conversely, “out of the money” implies the option has no intrinsic value at expiry. Familiarizing oneself with these terms is vital for effective decision-making in put option trading.

Strategies for Successful Put Option Trading

When delving into the world of put option trading, beginners must grasp fundamental strategies to thrive in the market. Understanding the basics of put options is crucial, as they provide the right to sell an asset at a predetermined price within a specified timeframe. One strategy to consider is buying put options as a form of insurance to protect your portfolio from potential downturns in the market.

Another vital tactic is mastering the art of timing. Knowing when to enter and exit trades can make or break your success in put option trading. Additionally, learning how to analyze market trends and indicators can greatly enhance your decision-making process. By honing these strategies and staying informed about market developments, beginners can set themselves up for successful put option trading ventures.

Risk Management in Put Option Trading

Risk management is crucial in put option trading to protect your investments and minimize potential losses. Beginners in put option trading must understand the importance of setting stop-loss orders to limit downside risk. By setting predetermined exit points, traders can control their losses and prevent emotional decision-making during market fluctuations.

Additionally, diversifying your investment portfolio can spread risk across different assets and reduce the impact of potential losses in put option trading. It is advisable to allocate a portion of your capital to lower-risk investments to balance the overall risk exposure. Moreover, staying informed about market trends and conducting thorough research before making investment decisions are essential strategies for effective risk management in put option trading.

Choosing the Right Stocks for Put Options

When delving into **Put Option Trading**, selecting the appropriate stocks is crucial for success. Investors should focus on companies with declining stock prices or those expected to face challenges in the near future. These stocks often present lucrative opportunities for put options, allowing traders to profit from downward movements.

Furthermore, analyzing stock volatility and market trends can aid in identifying the right stocks for put options. It’s essential to consider factors such as historical price movements, company performance, and upcoming events that could impact stock prices. By conducting thorough research and staying informed about market developments, traders can make informed decisions and maximize their profits in **Put Option Trading**.

Tools and Platforms for Executing Put Option Trades

When engaging in Put Option Trading, utilizing the right tools and platforms is crucial for successful trades. Platforms like E*TRADE and thinkorswim by TD Ameritrade offer advanced options trading capabilities, providing real-time data and analysis tools essential for decision-making. These platforms empower beginners to execute put option trades effectively.

Additionally, tools such as OptionsHouse and TradeStation offer user-friendly interfaces and educational resources tailored for those new to put option trading. By leveraging these tools and platforms, beginners can gain confidence in their trading strategies and make informed decisions when entering the complex world of put option trading. Mastering the art of put option trading becomes more manageable with the right tools and platforms at your disposal.

Real-life Examples of Put Option Trading Success Stories

Explore real-life success stories of individuals who have mastered Put Option Trading. From beginners to seasoned traders, these examples showcase the potential for success in the world of options trading. Understanding the intricacies of Put Option Trading can lead to significant profits for those willing to learn and take calculated risks.

One success story features a novice trader who diligently studied Put Option Trading strategies and applied them with discipline. Through careful analysis and risk management, they turned a small investment into substantial gains. Another example highlights a professional trader who utilized advanced Put Option strategies to hedge against market downturns effectively. These stories illustrate the lucrative opportunities available in Put Option Trading for those who are dedicated to mastering the craft.

Mistakes to Avoid in Put Option Trading

When engaging in Put Option Trading, beginners should steer clear of common mistakes to secure successful outcomes. One crucial error to avoid is neglecting thorough research before making trading decisions. For novice traders, it’s vital to analyze market trends, assess underlying assets, and stay informed about the factors influencing put option prices.

Another mistake to dodge is overlooking risk management strategies. Novices often fail to set stop-loss orders or establish exit points, exposing themselves to significant losses. Implementing risk management techniques, such as limiting the size of trades and diversifying options, can safeguard beginners from potential financial pitfalls in Put Option Trading. By evading these blunders, beginners can enhance their trading acumen and achieve better results in the dynamic world of options trading.

Conclusion: Mastering Put Option Trading – Your Path to Financial Empowerment

Mastering Put Option Trading can be your ticket to financial empowerment. Understanding the intricacies of Put Option Trading is crucial for those looking to diversify their investment portfolio. Beginners should grasp the basics of Put Option Trading to make informed decisions and mitigate risks.

By delving into the nuances of Put Option Trading, investors can enhance their financial knowledge and potentially boost their returns. Learning how to effectively utilize Put Options can offer a strategic advantage in volatile markets, allowing investors to capitalize on downward price movements. Empower yourself by mastering Put Option Trading and unlocking its potential to safeguard your investments and maximize profits.