In the fast-paced world of trading, where every fraction of a point can make a significant difference, mastering the art of pips becomes paramount. Imagine delving into the intricate web of financial markets, where tiny movements hold the key to unlocking substantial gains or losses. Welcome to the realm where precision reigns supreme, and understanding the nuances of pips can be the differentiating factor between success and mediocrity. Embark on a journey with us as we unravel the complexities surrounding pips in the realm of trading. This comprehensive guide is not just another list of definitions and equations; it’s a roadmap to empower traders with the knowledge and insights needed to navigate the tumultuous waters of the financial markets effectively. Whether you’re a novice eager to grasp the basics or a seasoned trader looking to fine-tune your strategies, this blog post is your gateway to demystifying the enigmatic world of pips and harnessing their power to elevate your trading prowess.

Understanding the Basics of Pips in Trading

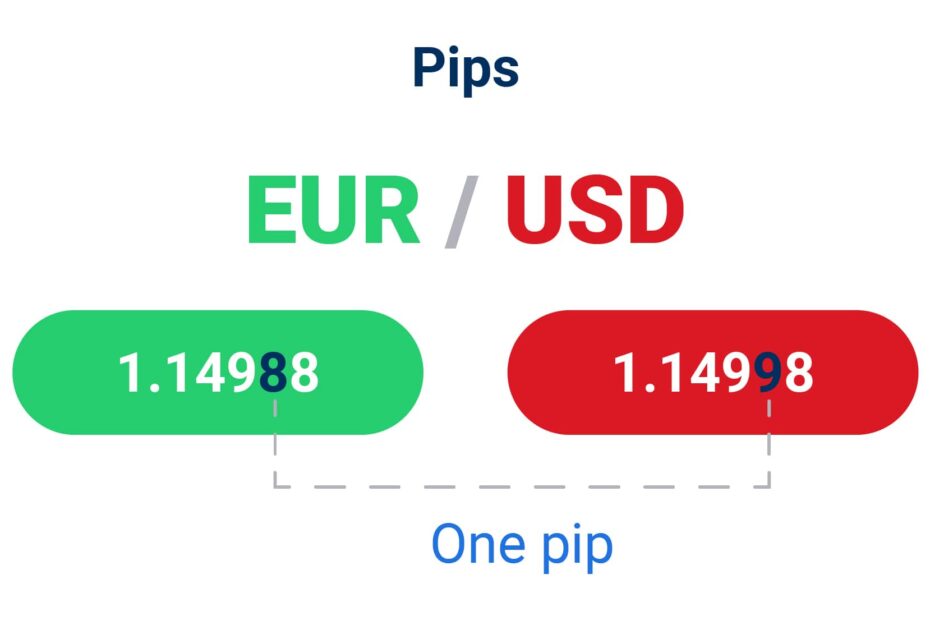

In trading, understanding the basics of pips is fundamental. Pips, or “percentage in point,” represent the smallest price movement that a currency pair can make. For most currencies, a pip is equivalent to 0.0001, except for the Japanese yen pairs where it is 0.01. Traders use pips to measure price changes and calculate profits or losses accurately.

Mastering the art of pips is crucial for traders to strategize effectively. By knowing how to calculate pips and understand their value in different currency pairs, traders can make informed decisions. Monitoring pips helps traders manage risks, set stop-loss levels, and determine position sizes accurately. Developing a solid grasp of pips is a key step towards becoming a successful trader in the dynamic world of forex trading.Importance of Precision: How Pips Influence Trading Decisions

Understanding the importance of precision in trading is crucial for traders looking to make informed decisions. Pips, the smallest price increment in forex trading, play a significant role in determining profit and loss. Traders analyze pips to gauge market movements accurately and execute trades with precision.

Mastering the art of pips empowers traders to navigate the volatile forex market effectively. Each pip movement influences trading decisions, making it essential for traders to grasp their impact comprehensively. By honing their skills in measuring and interpreting pips, traders can enhance their trading strategies and optimize their profitability in the dynamic forex landscape.

Differentiating Between Pipettes and Pips: A Critical Distinction

When it comes to trading, understanding the difference between pipettes and pips is crucial. Pips refer to the smallest price movement in the forex market, typically the fourth decimal point for most currency pairs. On the other hand, pipettes are even smaller increments, one-tenth of a pip. Traders often monitor these changes closely to make informed decisions.

Mastering the art of pips involves not only grasping their significance but also knowing how to leverage them effectively in trading strategies. By honing your skills in analyzing and interpreting pip movements, you can enhance your trading performance and capitalize on market fluctuations. Remember, every pip or pipette counts in the dynamic world of forex trading.

Calculating Profits and Losses in Pips: Strategies for Success

Understanding how to calculate profits and losses in pips is essential for traders aiming for success in the forex market. Each movement in the exchange rate is measured in pips, representing the smallest price change that a given exchange rate can make. By mastering the art of pips, traders can effectively strategize their trades based on these incremental movements.

To calculate profits and losses in pips, traders need to consider the pip value, which varies based on the currency pair being traded. Implementing strategies that focus on maximizing profits while minimizing losses in pips can significantly impact a trader’s overall success. By carefully analyzing market trends and leveraging pips effectively, traders can enhance their trading performance and achieve their financial goals.

Leveraging Pips in Risk Management: Mitigating Potential Losses

When it comes to risk management in trading, understanding how to leverage pips is crucial. Pips, as the smallest price change that a given exchange rate can make, play a significant role in mitigating potential losses. By setting stop-loss orders based on pips, traders can limit their downside risk effectively.

Mastering the art of pips involves not only knowing how to calculate their value but also implementing strategies that consider them in risk management. Traders can use the concept of pips to determine their position sizing accurately, ensuring that potential losses are controlled. In this comprehensive guide for traders, learning how to leverage pips in risk management will be a game-changer in navigating the volatile world of trading.

The Role of Pips in Setting Stop Loss and Take Profit Levels

Understanding the significance of pips is crucial for traders when setting stop loss and take profit levels. Pips, or percentage in points, represent the smallest price movement in the exchange rate of a currency pair. They play a vital role in determining potential profits or losses in a trade. When setting stop loss levels, traders often calculate the number of pips they are willing to risk to protect their capital from significant losses. Similarly, take profit levels are strategically set based on the desired number of pips to secure profits before the market reverses.

Mastering the art of pips involves meticulous analysis and risk management. Traders should consider the volatility of the market, the currency pair’s average daily range, and technical indicators to optimize their stop loss and take profit levels effectively. By harnessing the power of pips, traders can enhance their decision-making processes and improve their overall trading performance.

Advanced Techniques for Maximizing Profits Through Pips

To maximize profits through pips, traders can employ advanced techniques that go beyond basic strategies. One effective approach is utilizing trailing stops, a method that allows traders to lock in profits as the market moves in their favor. By adjusting stop-loss orders as the trade progresses, traders can secure gains while letting profits run.

Another advanced technique is scaling in and out of trades strategically. Traders can enter a position with a partial lot size and add to it as the trade gains momentum, maximizing profits. Similarly, scaling out involves gradually closing parts of the position as the trade progresses to secure profits at different price levels. These techniques require careful planning and risk management but can significantly enhance profitability in the forex market.

Common Pitfalls to Avoid When Dealing with Pips in Trading

When engaged in trading, understanding the significance of pips is crucial. One common pitfall that traders must avoid is overlooking the impact of pips on their overall profits or losses. Ignoring the value of each pip can lead to miscalculations and poor risk management strategies, which can ultimately result in significant financial setbacks.

Another pitfall to steer clear of is fixating solely on the number of pips gained or lost in a trade, neglecting the context of the market conditions and risk-to-reward ratio. Focusing only on pips without considering these critical factors can lead to impulsive decision-making and excessive trading based on emotions rather than a well-thought-out strategy. To navigate these pitfalls successfully, traders must maintain a balanced approach that incorporates both the importance of pips and a comprehensive understanding of market dynamics.

Incorporating Pips into Your Trading Strategy: Tips and Best Practices

When it comes to enhancing your trading strategy, **Pips** play a crucial role. To effectively incorporate **Pips** into your trading approach, consider these tips and best practices. Firstly, understand the significance of **Pips** as they represent the smallest price movement in currency trading. By mastering the art of calculating and utilizing **Pips**, traders can make informed decisions based on precise market movements.

Moreover, to optimize your trading strategy, focus on setting realistic profit targets based on **Pips** gained or lost. Implement risk management techniques that align with your **Pips** goals to maximize profitability and minimize potential losses. Additionally, continuously analyze and adjust your strategy to adapt to changing market conditions and ensure consistent success in your trading endeavors.

Elevating Your Trading Game: Mastering the Art of Pips

To excel in trading, mastering the art of pips is essential. Understanding how pips work and their significance in forex trading can significantly elevate your trading game. Pips, short for “percentage in point,” represent the smallest price movement in the exchange rate of a currency pair. Being able to calculate and interpret pips accurately allows traders to determine their profit or loss with precision.

Successful traders pay close attention to pip values, as they directly impact profits and losses. By mastering the art of pips, traders can make informed decisions on trade entries and exits, manage risk effectively, and optimize their overall trading strategy. Developing a deep understanding of pips empowers traders to enhance their trading skills and achieve consistent success in the dynamic world of trading.