In the world of trading, deciphering market trends can often feel like navigating a complex maze of numbers and charts. But what if there was a powerful tool that could unravel these mysteries and provide a clear roadmap to trading success? Enter the head and shoulders candlestick pattern – a dynamic and versatile analysis technique that seasoned traders swear by. Picture this: a pattern that not only identifies potential trend reversals but also offers valuable insights into market psychology. As you delve into the nuances of the head and shoulders candlestick pattern, you’ll uncover a treasure trove of information that can elevate your trading game to new heights. Whether you’re a novice trader looking to sharpen your skills or a seasoned pro aiming to refine your strategies, mastering this pattern is a game-changer that can set you apart in the competitive world of trading. Join us on a journey through the intricacies of this powerful tool, and unlock the secrets to interpreting market trends with precision and confidence.

Understanding the Basics of Candlestick Patterns

Candlestick patterns are vital in market analysis, with the Head and Shoulders Candle Stick Pattern being a key player. This pattern signifies trend reversal, consisting of three peaks where the middle one is the highest – resembling a head between two shoulders. Traders keen on market trends can leverage this pattern to anticipate potential shifts, thus making informed decisions.

Understanding the basics of the Head and Shoulders Candle Stick Pattern is crucial for mastering market analysis. By recognizing this pattern’s formation and interpreting its implications accurately, traders can gain an edge in predicting market movements. With its distinctive shape and clear signals, incorporating this pattern into analytical strategies can significantly enhance trading outcomes.

Introduction to Head and Shoulders Pattern

The Head and Shoulders candlestick pattern is a powerful tool in market analysis. This pattern typically indicates a reversal in the current trend, offering traders valuable insights for decision-making. Recognizing the distinctive shape of a Head and Shoulders pattern can help traders anticipate potential shifts in market direction.

Traders can use technical analysis to identify the formation of the Head and Shoulders pattern, consisting of a peak (head) between two lower peaks (shoulders). This pattern signals a transition from bullish to bearish sentiment or vice versa, depending on its orientation. By understanding how to interpret and apply the Head and Shoulders candlestick pattern, traders can enhance their ability to forecast market movements accurately.

Anatomy of a Head and Shoulders Pattern

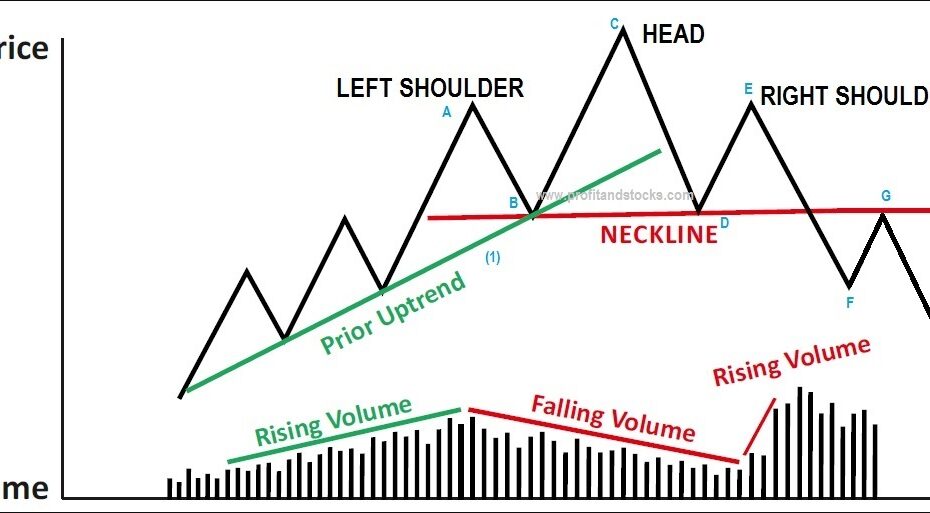

Understanding the anatomy of a Head and Shoulders pattern is crucial for mastering market analysis. This classic reversal pattern consists of three peaks: the left shoulder, head, and right shoulder, signaling a potential trend change. The neckline acts as a support level, and a break below it confirms the pattern.

In the Head and Shoulders Candle Stick Pattern, traders look for specific candle formations at each stage of the pattern to validate their analysis. The left shoulder and head are characterized by bullish candles, while the right shoulder often forms with weaker candles indicating a loss of bullish momentum. Recognizing these candle patterns can help traders anticipate price movements and make informed trading decisions.

Identifying the Head and Shoulders Formation on Charts

When examining charts for market analysis, recognizing the head and shoulders candlestick pattern is crucial. This formation consists of three peaks, with the middle one being the highest, resembling a head between two shoulders. Traders often see this pattern as a potential reversal signal from bullish to bearish trends, highlighting a shift in market sentiment.

To master market analysis using the head and shoulders candlestick pattern, it’s essential to pay attention to the neckline, which connects the lows of the two shoulders. A confirmed break below this neckline typically indicates a high probability of further price decline. By identifying and understanding this pattern, traders can make informed decisions and capitalize on potential market reversals.

Trading Strategies Using the Head and Shoulders Pattern

Trading strategies using the Head and Shoulders pattern can provide valuable insights into market trends. This pattern is a reliable indicator of potential trend reversals, offering traders opportunities to enter or exit positions profitably. By understanding the formation of the Head and Shoulders pattern, traders can make informed decisions based on the pattern’s confirmation signals.

Mastering market analysis with the Head and Shoulders candlestick pattern involves recognizing its distinctive shape and interpreting its implications correctly. Traders can use this pattern to identify possible entry and exit points, manage risk effectively, and maximize profit potential. Incorporating this powerful pattern into trading strategies can enhance overall performance in various financial markets.

Confirmation Signals and Validation Techniques

Confirmation signals play a crucial role in mastering market analysis using the Head and Shoulders Candle Stick Pattern. To validate trading decisions based on this pattern, traders must understand key validation techniques to increase their chances of success. By recognizing specific confirmation signals within the pattern, traders can gain confidence in their market predictions.

Implementing validation techniques such as volume analysis and trendline confirmation enhances the reliability of Head and Shoulders Candle Stick Pattern signals. These techniques provide traders with additional insights into market dynamics, helping them make informed trading decisions. Ultimately, mastering these confirmation signals and validation techniques is essential for effectively utilizing the Head and Shoulders Candle Stick Pattern in market analysis.

Common Mistakes to Avoid When Trading with Head and Shoulders

When trading with the Head and Shoulders candlestick pattern, it’s crucial to avoid common mistakes that can lead to losses. One frequent error is overlooking the volume confirmation, as trading based solely on the pattern without significant volume support can result in false signals. Another pitfall to steer clear of is ignoring the neckline break, as this breakout confirmation is essential for accurate trading decisions.

Additionally, failing to consider the overall market trend before trading with the Head and Shoulders pattern can lead to costly mistakes. It’s vital to analyze the broader market context to align your trades effectively. By avoiding these mistakes and staying attentive to volume, breakout levels, and market trends, traders can master the art of trading with the Head and Shoulders candlestick pattern successfully.

Case Studies: Real-World Application of Head and Shoulders Pattern

Explore real-world applications of the Head and Shoulders candlestick pattern through case studies. These studies delve into how this pattern manifests in different market scenarios, offering valuable insights for traders. By examining actual market data, traders can gain a deeper understanding of how the Head and Shoulders pattern influences price movements.

In these case studies, we analyze the formation of the Head and Shoulders pattern in various market conditions. Understanding the intricacies of this pattern can enhance market analysis techniques and decision-making processes for traders. By applying these real-world examples, traders can sharpen their skills in identifying and utilizing the Head and Shoulders pattern effectively.

Enhancing Market Analysis Skills with Additional Technical Indicators

Developing a deep understanding of market analysis can be further enriched by incorporating additional technical indicators into your trading strategy. By mastering the Head and Shoulders Candle Stick Pattern, traders can gain valuable insights into potential trend reversals and market sentiment shifts. This technical indicator, when used in conjunction with other tools like moving averages and RSI, can provide a comprehensive analysis of market dynamics.

Integrating the Head and Shoulders Candle Stick Pattern into your analytical toolkit enhances your ability to identify key market trends and make informed trading decisions. Whether you are a novice trader or an experienced investor, mastering this pattern can significantly boost your market analysis skills and improve your overall trading performance. Stay ahead of the market curve by incorporating diverse technical indicators like the Head and Shoulders Candle Stick Pattern into your trading strategy.

Conclusion: Elevate Your Trading Game with Head and Shoulders Strategy

Master market analysis by incorporating the powerful Head and Shoulders candlestick pattern into your trading strategy. This classic chart formation signals potential trend reversals, providing valuable insights for traders. By identifying the distinctive shape of three peaks, with the middle peak being the highest, followed by a neckline, traders can anticipate shifts in market direction.

The Head and Shoulders pattern is a versatile tool that can be applied across various financial markets, offering traders a strategic edge in decision-making. This reliable pattern is highly regarded for its ability to indicate upcoming price movements, aiding traders in maximizing their profits and minimizing risks. Elevate your trading game by mastering the Head and Shoulders candlestick pattern and harness its predictive power for successful trading ventures.