Finding a reliable partner is the first real hurdle for any new trader. Most beginners lose their initial capital not because of bad trades, but because they chose a platform with predatory fees or poor execution. We want you to avoid those mistakes. To identify the best forex brokers, we analysed regulatory compliance, cost structures, and the quality of beginner-friendly tools.

The market in 2026 is faster than ever. Technology has shifted from simple charts to AI-driven insights and instant liquidity. You need a broker that does more than just execute orders. You need a partner that keeps your funds safe while providing the data required to stay ahead. We spent months testing these platforms to ensure they meet the highest standards of safety and performance.

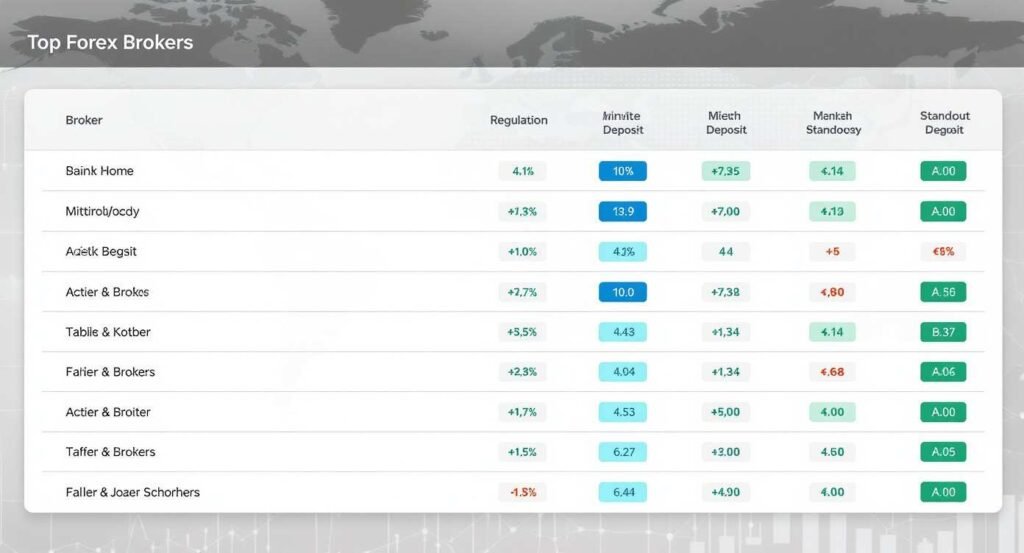

Comparison of the Best Forex Brokers 2026

Structure wins in 2026. This table provides the hard data you need to make an immediate decision without digging through paragraphs.

| Broker | Top Regulation | Min. Deposit | Standout Feature |

| IG Group | FCA, ASIC | $250 | Best Market Range |

| eToro | CySEC, FCA | $10 – $200 | Copy Trading Leaders |

| Pepperstone | ASIC, FCA | $0 | Raw ECN Spreads |

| XTB | KNF, FCA | $0 | Proprietary xStation 5 |

| AvaTrade | Central Bank of Ireland | $100 | Fixed Spread Options |

| Saxo Bank | Danish FSA | $2,000 | Institutional Quality |

| Plus500 | FCA, ASIC | $100 | Simplest Interface |

| CMC Markets | FCA, ASIC | $0 | Advanced Data Tools |

| Tickmill | FCA, CySEC | $100 | Lowest Commissions |

| FP Markets | ASIC, CySEC | $100 | Direct Market Access |

Why Your Choice of Broker Matters in 2026?

Many new traders assume all platforms are essentially the same. This logic is a fast track to losing money. A broker is your gateway to the $7.5 trillion-a-day currency market. If that gateway is built on slow technology, you will suffer from slippage—the difference between the price you want and the price you get. The best forex brokers minimise this gap.

Security is also a major concern. In 2026, we only look for brokers that offer negative balance protection and segregated accounts. Segregated accounts ensure that your money is not used for the company’s operational debts. If a broker is not transparent about where your money sits, do not give them a single cent.

IG Group: The Industry Standard

We rank IG as the top choice for overall reliability. They have survived every market crash for decades. For a beginner, their platform feels professional yet easy to master. You get access to over 17,000 markets. This means as you grow, you won’t need to find a new broker to trade stocks or indices.

Their education is world-class. The IG Academy provides step-by-step courses that avoid confusing jargon. We also appreciate their pricing transparency. You see every fee before you commit to a trade. It remains a premier choice for those starting today.

eToro: The Power of Social Trading

If the idea of analysing charts alone feels heavy, eToro is the solution. They pioneered social trading. This allows you to follow successful investors and see their trades in real time. You can use the “CopyTrader” function to mirror their moves dollar-for-dollar.

We suggest using this as a training tool. Don’t just follow people. Look at why they opened a position. The interface is clean and reminds us of a social media feed. It removes the fear often found in traditional trading desks. They are easily one of the best forex brokers for building a community-driven strategy.

Pepperstone: Built for Speed

We recommend Pepperstone for those who want to trade like the pros from day one. Their “Razor” account offers spreads as low as 0.0 pips. You pay a small commission instead of a marked-up price. Over time, this saves you a massive amount of money.

Their support team is excellent. If you have an issue during high-volatility events, they actually pick up the phone. They support MT4, MT5, and TradingView. These are the tools used by professional fund managers. Getting used to these early will pay off as you gain experience.

CMC Markets: The Data Scientist’s Choice

Some beginners want to dive straight into technical analysis. CMC Markets provides the tools to do it right. Their “Next Generation” platform has over 115 technical indicators. We found their price alerts to be the most reliable in the industry.

They provide deep market insights every day. Their team of analysts breaks down complex events like interest rate hikes into simple, actionable facts. We like that they don’t use marketing hype. They give you the numbers and let the data speak for itself.

XTB: Top-Tier Mobile Performance

XTB’s xStation 5 is one of the most stable platforms we have ever used. It is fast, and it rarely lags, even when the news drops. For beginners, they offer a personal account manager. This is a human being you can talk to about setting up your charts or understanding your margin.

Their education is categorised by skill level. You start with “Basic” and progress as you learn. This structure prevents you from feeling buried in information. They are a great pick for traders who need a mix of solid desktop tools and a powerful mobile app.

Saxo Bank: The Premium Experience

Saxo Bank is for traders who can afford a higher entry point. They are an institutional-grade bank, which means the level of safety is unmatched. Their research is legendary. They provide “SaxoStrats” reports that go deeper than any other retail broker.

The platform is sleek and very powerful. It feels expensive because it is. If you want a broker that you can stay with for the next twenty years, Saxo is the one. Just be ready for the $2,000 minimum deposit required to open a starter account.

AvaTrade: Protection for Your Capital

AvaTrade offers something no one else does: AvaProtect. This is essentially insurance for your trades. For a small fee, you can protect a position from losses for a set period. For a beginner who is still learning how to manage risk, this is a massive advantage.

They also provide fixed spreads. Most brokers have variable spreads that can widen during news events. With AvaTrade, you know exactly what your cost is at all times. This makes it much easier to calculate your potential profit and loss.

Tickmill: The Low-Cost Warrior

If every dollar counts, Tickmill is your best bet. Their commissions are some of the lowest we have ever seen. They focus on providing a lean, high-speed environment for technical traders. We found their order execution to be lightning-fast.

They offer a wealth of webinars and seminars. Their focus is on the psychology of trading. This is often ignored by other brokers, but we think it is the most important part of success. Learning to manage your emotions is as vital as learning the charts.

Plus500: No-Fuss Trading

Plus500 is for the minimalist. Their platform is intentionally simple. There are no complex sub-menus or hidden settings. You pick a pair, and you trade it. They are an FTSE 250 company, which adds a layer of trust that smaller brokers cannot match.

Their app is consistently rated as one of the best on the App Store. We found it very easy to manage trades while away from the computer. If you want a direct experience without any distractions, Plus500 is a safe choice.

FP Markets: The Aussie Powerhouse

FP Markets uses ECN (Electronic Communication Network) technology to link you to big banks. This means you get the best possible prices from Tier-1 liquidity providers. We like them because they offer over 10,000 tradable symbols.

They offer free VPS (Virtual Private Server) hosting if you trade enough volume. This allows your platform to stay connected to the markets 24/7 without being interrupted by your home internet connection. It is a high-level feature that they make accessible to smaller traders.

How to Spot a Bad Broker Before You Deposit?

We have to be direct here. There are scams everywhere. Many offshore brokers will offer you 1000:1 leverage and “deposit bonuses.” These are traps. Usually, these bonuses come with terms that make it impossible to withdraw your money until you have traded a massive amount.

Always check for a license number. Go to the regulator’s website—like the FCA in the UK or ASIC in Australia—and type that number in. If it doesn’t match the broker’s name, walk away. A good broker will also process your withdrawals within two business days. If they start asking for “one more document” every time you want your money, that is a red flag. The best forex brokers want you to stay because of their service, not because they are holding your money hostage.

The Role of Education in Your Success

Do not gamble with real money until you have used a demo account. Every broker on this list provides one. A demo account uses virtual funds but shows real market prices. Spend at least a month here. Get used to the buttons, the charts, and the speed of price movements.

When you do go live, start small. The 1% rule is your best friend. Never risk more than 1% of your total account on a single trade. If you have $1,000, don’t lose more than $10. This keeps you in the game even if you have a losing streak. Discipline is the only thing that separates a trader from a gambler.

Key Trends for Forex in 2026

The market is currently being reshaped by AI and digital assets. Many brokers now allow you to fund your account using stablecoins like USDC. This makes the process faster and often avoids bank fees. We are also seeing AI assistants integrated into platforms. These tools can scan thousands of charts in a second to find patterns for you.

Regulation is also evolving. We are seeing more focus on “Gamification” and ensuring brokers don’t encourage reckless trading. This is a win for you. It means the best forex brokers are being forced to become more transparent and more focused on your long-term success rather than just your trade volume.

Final Thoughts on Choosing a Platform

Choosing from the best forex brokers is a personal decision. You need to identify what matters most to your style. Are you looking for the lowest cost? Go with Pepperstone or Tickmill. Do you want to copy others? eToro is the winner. Do you want the safest possible bank? Look at Saxo Bank.

We suggest opening two or three demo accounts. Spend a few hours on each platform. See which one feels natural to you. Your broker is your most important tool. You need to trust the technology and the people behind it. Once you have that trust, you can focus on the hard work of reading the markets.

FAQs

Which is the best forex broker for a small deposit?

For deposits under $500, we recommend XTB or eToro. They have low entry barriers and offer micro-lots, which allow you to trade with very small amounts of risk while you learn.

Are these brokers safe to use?

Yes. We only reviewed brokers that are regulated by Tier-1 or Tier-2 authorities. This includes the FCA, ASIC, and CySEC. These bodies ensure that the broker maintains enough capital and treats customers fairly.

Can I trade forex on my phone?

Every broker on our list has a mobile app. In 2026, mobile trading will be just as fast as desktop trading. However, we suggest doing your deep analysis on a computer and using your phone for monitoring and quick execution.

What is the most important factor when picking a broker?

Regulation and the cost of the “spread.” Regulation protects your money, and low spreads protect your profit. Never compromise on either.

How do I open a trading account?

Visit the broker’s website and click “Open Account.” You will need to provide a photo ID and a utility bill for address verification. Once they approve your documents, you can fund your account via bank transfer, card, or crypto. The process usually takes less than 24 hours.