Advanced Techniques for Forex Risk Management

Key Takeaways

- Advanced Risk Management Techniques are essential for navigating the dynamic forex market.

- Utilizing hedging strategies can effectively mitigate risks.

- Scaling in and out of positions enhances transaction management and profit realization.

- Automated trading systems offer a systematic approach to managing trading risks.

- Incorporating advanced metrics provides a comprehensive risk profile for better decision-making.

Table of contents

Forex risk management isn’t a static practice; it continually evolves with changing market dynamics and advances in trading technologies. Adopting advanced risk management techniques allows traders to navigate complex market movements more adeptly and safeguard against potential financial pitfalls. This section will delve deeper into advanced risk management practices, exploring the nuances of hedging, scaling in and out of positions, and integrating automated trading algorithms.

1. Exploring Hedging Strategies in Risk Management

Hedging is a practice used by traders to offset potential losses from investment risks. In the context of forex trading, this involves taking equal and opposite positions in the same currency pair or correlated currency pairs:

- Introduction to Hedging: A brief overview of the concept of hedging and its role in forex risk management.

- Hedging Strategies: In-depth look at different hedging methods, such as direct hedging and multiple currency hedging.

- Benefits and Drawbacks of Hedging: Evaluation of the pros and cons of hedging as a risk management strategy.

- Practical Hedging Examples: Real-world examples illustrating how hedging works in forex trading.

For more on hedging, you can refer to Investopedia – Forex Hedging: How to Create a Simple Profitable Hedging Strategy.

2. Scaling In and Out of Positions

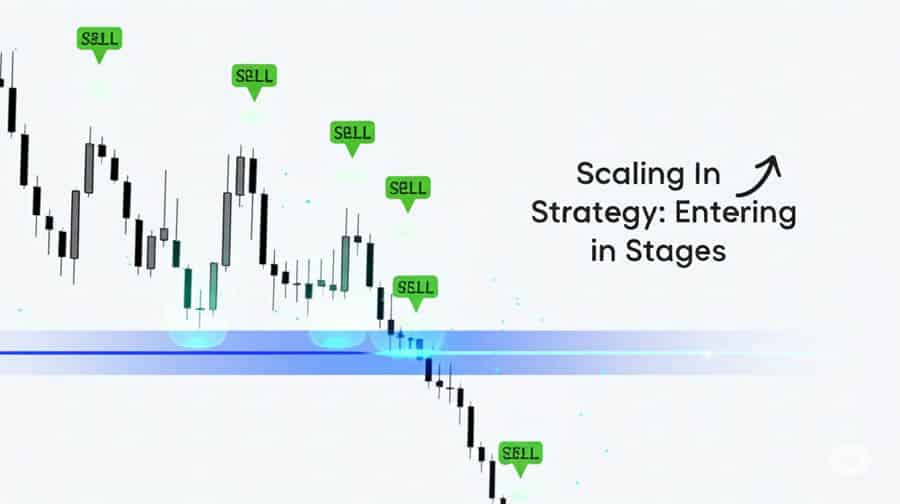

Another advanced risk management strategy is scaling in and out of positions, which aims to reduce potential losses and maximize profitable transactions:

- Understanding Scaling: Introduction to the concept of scaling, including breaking down larger trades into smaller parts to mitigate risks.

- Strategies for Scaling In: Detailed discussion on how to incrementally increase trading positions when market conditions are favorable.

- Strategies for Scaling Out: Explanation on how to gradually exit positions to secure profits and reduce losses during unfavorable conditions.

- Best Practices for Scaling: Practical guidelines on effective scaling, including timing and frequency.

Scalping offers another layer of control over trading risk. Learn more about the specifics at Trader Dale – Scaling In and Out of Trades.

3. Automated Trading and Risk Management

Automated trading systems provide a more systematic approach to risk management by removing emotional biases from trading decisions and ensuring adherence to pre-set trading parameters:

- Overview of Automated Trading: A brief introduction to automated trading, including its benefits and drawbacks.

- How Automated Systems Manage Risk: An exploration of how automated systems can help manage trading risks.

- Choosing the Right Trading Algorithm: Insight on how to select an algorithm that aligns with your trading strategy and risk tolerance (source).

- Training and Testing Your Algorithm: Guidance on developing, backtesting, and validating the effectiveness of your automated trading system.

To understand how automated systems enhance risk management, visit QuantInsti – Automated Trading and its Impact on Risk Management.

4. Advanced Risk Management Metrics

Beyond the basic risk-reward ratio, several other risk management metrics can provide a more comprehensive risk profile of your trading strategy:

- Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR): These statistical measures provide a worst-case scenario assessment of potential losses over a specific time period.

- Maximum Drawdown (MDD): MDD measures the largest peak-to-trough decline during a specific period, offering insights into historical risks.

- Sharpe Ratio: This ratio indicates how much excess return can be achieved for the extra volatility sustained by holding riskier assets.

Consider using these advanced metrics to enhance your risk analysis. To learn more, visit Investopedia – Key Forex Risk Management Metrics.

5. Risk Management in Algorithmic Trading

Risk management in algorithmic trading presents unique challenges and opportunities. Here, we explore risk management considerations specific to algorithmic trading:

- Risk Management Challenges in Algorithmic Trading: Discussion on potential risks, such as overfitting, system overloads, and the “black box” problem.

- Mitigating Algorithmic Trading Risks: Practical measures to minimize risk in algorithmic trading, including diligent backtesting, safeguards against system failures, and transparency measures (source).

- Best Practices for Algorithmic Trading Risk Management: Recommendations for a structured risk management framework for algorithmic trading.

To dig deeper into the topic, refer to QuantInsti – Risk Management in Algorithmic Trading.

Conclusion

The dynamic nature of forex trading requires an equally robust and adaptive risk management approach. By incorporating advanced techniques into their trading arsenal, traders can better navigate the complex forex landscape and safeguard their investments. The successful trader doesn’t solely rely on basic practices but continuously seeks to understand, incorporate, and adapt more advanced risk management strategies in their trading plan. It is this level of understanding and application that aids in sustained success in forex trading due to effective risk control (source).

For more insights, explore Investopedia – Advanced Risk Management Techniques and Blueberry Markets – Advanced Forex Risk Management. Remember, risk management is not a one-off activity but a continuing process that requires diligence and constant learning.

Frequently Asked Questions

- What is hedging in forex? Hedging in forex is a strategy that involves taking opposite positions in currency pairs to protect against potential losses.

- How does automated trading help manage risks? Automated trading systems execute trades based on pre-established rules, minimizing emotional decision-making and enhancing consistency in risk management.

- What metrics can be used for measuring trading risk? Key metrics include Value-at-Risk (VaR), Maximum Drawdown (MDD), and Sharpe Ratio, which provide insights into potential risks and returns.